Ohio phased out its corporate franchise tax over several years, with the final franchise tax returns filed for the 2013 tax year (based on taxable year ending in 2012). The tax was replaced by the Commercial Activity Tax (CAT) for most businesses and the Financial Institutions Tax (FIT) for banks, which became effective in 2014.

After eliminating the franchise tax, Ohio joined states like Washington, Nevada, and Wyoming as states without corporate income taxes. This cleanup was part of a broader tax makeover that began with Am. Sub. H.B. 66 in 2005. The franchise tax had earned the nickname "swiss cheese" because corporations could slip through its many loopholes. This reputation, paired with Ohio's quest for more predictable business taxation, led to its complete elimination.

Ohio not only eliminated the franchise tax, but it also implemented an entirely new taxation framework. This transformation introduced two different systems: the Commercial Activity Tax (CAT) for most businesses and the Financial Institutions Tax (FIT) for banks and financial entities.

Ohio's Commercial Activity Tax (CAT) taxes gross receipts, not profitability, affecting businesses regardless of their financial performance. While smaller businesses may be exempt due to exclusion thresholds, the CAT applies to nearly all business structures, unlike the franchise tax, which primarily targeted corporations.

The FIT was designed to be revenue-neutral, targeting approximately $200-225 million annually while closing loopholes that allowed some large institutions to avoid taxes under the previous franchise tax system. This separate tax system acknowledges the unique operational models of financial businesses like banks and credit unions, which don't fit standard business taxation.

With the introduction of the CAT and the FIT, there were significant changes in the taxing framework, including:

For businesses registered in Ohio or considering foreign registration, this tax restructuring significantly changed compliance requirements. Companies with operations in Ohio should ensure their registered agent is informed about these tax obligations, as they affect both domestic and foreign-registered entities.

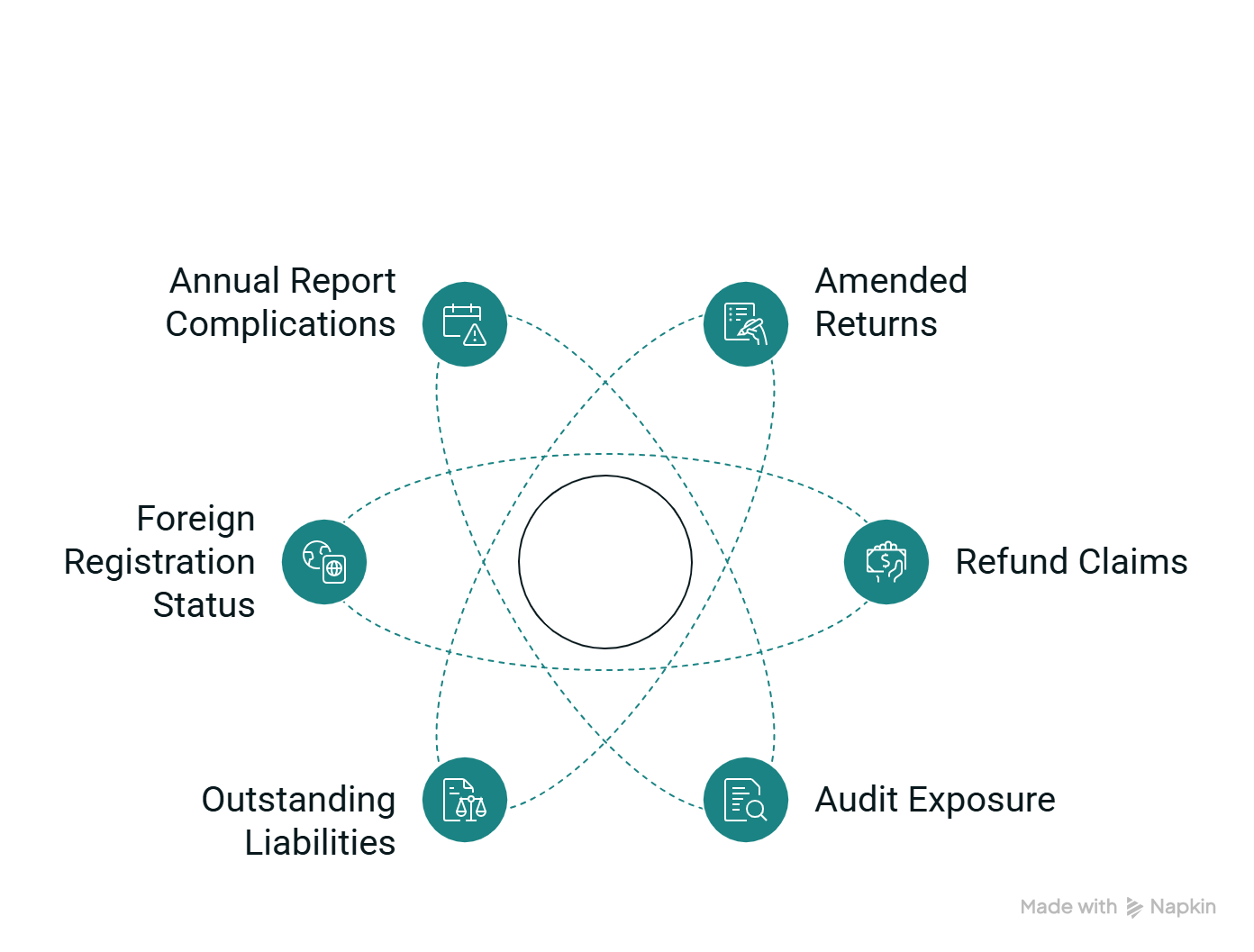

Though Ohio's franchise tax ended in 2014, several important issues remain relevant for businesses that operated in Ohio before the repeal:

Businesses should maintain pre-2014 tax records and consult with professional entity compliance services to address these legacy issues, especially before major organizational changes or when closing operations in Ohio.

The CAT is fundamentally different from the old franchise tax. The franchise tax was based on net income or net worth, while the CAT taxes gross receipts regardless of profitability. This shifts the tax burden—a profitable company with low sales might have paid more under the old system, while a high-volume, low-margin business could pay more under CAT.

LLCs that were subject to the franchise tax (those electing corporate taxation) are now potentially subject to the CAT if their Ohio gross receipts exceed current thresholds. The CAT applies more broadly than the franchise tax did, reaching nearly all business types with Ohio gross receipts above the threshold, regardless of legal structure.

Ohio's Commercial Activity Tax and Financial Institutions Tax require professional tax expertise and are filed through the state's tax system.

While Discern does not file Ohio business taxes directly, Discern can file your Ohio annual reports with the Secretary of State, provide registered agent services, and help you track compliance across all your entities.

Book a demo to see how Discern streamlines entity management across all 50 states and DC.